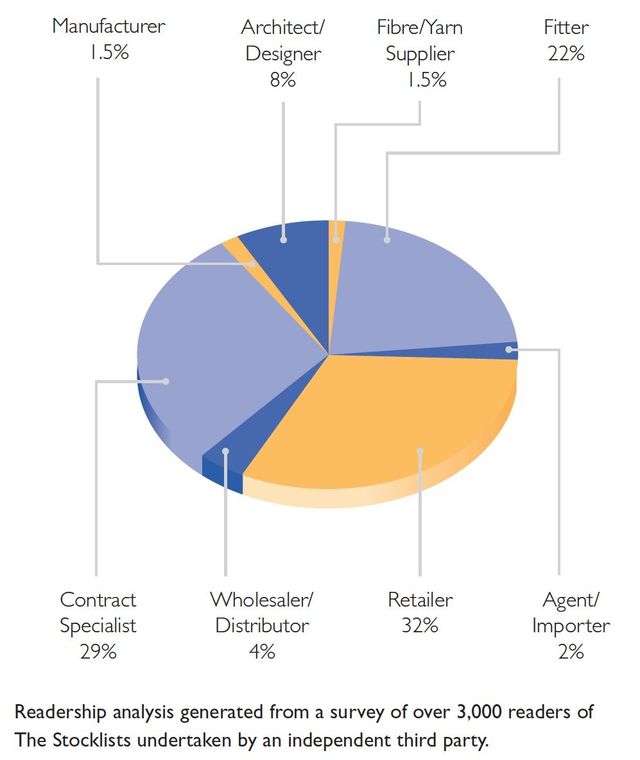

The best-read trade title for flooring retailers and buyers

Unrivalled access to UK flooring trade buyers

- 7,000 print circulation

- 4,000 online recipients

- c. 20,000 readers!

- Print and online - the best of both worlds

- Effective recruitment and classified advertising

Wilsons Furnishers, the parent company of both Wilsons Carpets and Online Carpets, saw its profits rise to more than £2.4m in 2024, compared with a figure of £1.2m over the previous period. In its filings, the company’s directors said they were pleased to report the business performed “satisfactorily” during the year, and that it would continue to make investments into the business and people. According to these same filings, Wilsons Furnishers’ trading throughout 2024/2025 has thus far been in line with expectations, however it does point out increased operational and staff employment costs (owing to “increased UK government tax policies, international geo-political tensions and foreign exchange fluctuations”) as principal risks for the ongoing period.

UK floorcoverings distributor Likewise Group held its annual general meeting (AGM) recently and the company is reportedly pleased to announce a continuation of the “very positive” sales trajectory reported earlier in the year as it approaches the end of H1 25. At the meeting, Tony Brewer, chief executive of Likewise, provided the following update to shareholders. Total gross sales revenue to 26 June 2025 has increased by 10.0% against the corresponding period last year, with absolute like for like being slightly stronger due to one less working day this year. The group with its two principal businesses, Likewise Floors and Valley Wholesale Carpets, continues to expand presence in flooring retailers and contractors through ever increasing point of sale displays, undoubtedly gaining market share despite what remains a subdued trading environment. Likewise will release its interim results for the six-month period ended 30 June 2025 on 9 September 2025. Tony Brewer, chief executive of Likewise Group plc, said: “It is really encouraging to see the investments made in the last four years really starting to deliver meaningful improvements in sales and subsequent profitability. The group continues to make significant progress towards our medium-term objectives of sales revenue well in excess of £200 million. “We have great teams of people in our various businesses and thank all our employees for their contributions as we look forward to an exciting future. Furthermore, we very much appreciate the continued support of suppliers, customers, shareholders and all stakeholders.”

In this article, independent flooring consultant Richard Renouf explains how a customer’s rights and obligations change depending on the method of payment. So far in this series of articles we’ve looked at the things we need to consider when we sell to customers in a shop, and I’ve promised to look at online and off-premises sales in a future article. Before I do this, however, there’s an important matter we must consider. How did the customer pay? Credit card and store card payments and finance agreements (including interest-free credit) give the customer the right to claim against the finance provider instead of, or in addition to, the retailer; and other card or bank transactions may also give the customer the ability to ask for help from their bank. The Consumer Credit Act 1974 (CCA) was introduced to clarify the legal responsibilities of the parties involved in a credit sale. Usually there is the customer, the retailer and the finance provider and the transaction is actually circular: The consumer offers to buy the goods and enters an agreement to pay the finance provider, the retailer supplies the goods to the consumer but obtains payment from the finance provider (usually with the provider taking a commission or percentage), the finance provider pays the retailer and then recoups the purchase price and any agreed interest from the consumer. The advantage to the consumer is that they can spread the cost and have the goods immediately. The advantage to the retailer is that they get prompt payment from the finance provider, and, of course, the finance provider also makes a profit from the sale. The CCA makes clear that even though the consumer is actually purchasing from the finance provider, both the retailer and the finance provider have legal obligations under the contract even though the provider may never actually see the consumer or the goods. These obligations continue even if one of them goes out of business. If the consumer has a valid complaint, the CCA allows the consumer to claim against the finance provider as long as the purchase was more than £100 and less than £30,000, and it allows the consumer to claim the whole cost of the sale even if they only paid a small part of this on their credit card. The legal requirements are set out in Section 75 of the CCA and so a claim made under this legislation is often referred to as a ‘Section 75 Claim’. Before such a claim could be made in court the consumer must have contacted the finance provider to give them an opportunity to resolve the complaint, and the finance provider will have a procedure to investigate the complaint by contacting the retailer for information and possibly by asking the consumer to get an independent expert’s report where there is disagreement. If this does not get the complaint resolved, the consumer can raise a Section 75 Claim in the county court against the finance provider, or both the finance provider and the retailer. A chargeback may be part of the Section 75 process, but it can also by done by any bank or finance provider if their customer raises a query about a payment they have made. The bank can withhold payment to the retailer – or even take it back from their account – until the matter is investigated and the finance provider is satisfied that it should be repaid to one of the parties. The terms of the Mastercard, Visa, Amex and merchant processors allow for this to be done without asking the retailer first. Usually the retailer is told when it has been done and is then given a limited time to explain their side of things, and if this is not done on time or to the finance provider’s satisfaction the money will be returned to the consumer. Prompt attention to any chargeback can be successful when the complaint is not valid, but a poor response or failure to respond on time would make it very difficult to challenge and reverse the chargeback through the finance provider. Chargebacks can be made even when a customer has not made a complaint to the retailer, and so the retailer is unaware of any issues. I have never known a retailer succeed in suing a finance company over a chargeback they did not agree with, but, I have known cases where finance providers have rejected consumer complaints and the consumer has then proceeded to make a successful Section 75 Claim though the County Court which then, of course, results in a chargeback to the retailer. An unhappy consumer could also make a complaint to the Financial Ombudsman and as this is costly for the finance company this is something they try to avoid and may result in them doing a chargeback because it is the cheapest option. Citizen’s Advice (citizensadvice.org.uk) and Money Saving Expert (moneysavingexpert.com) have excellent guidance on their websites. www.richard-renouf.com

Unrivalled access to UK flooring trade buyers

- 7,000 print circulation

- 4,000 online recipients

- c. 20,000 readers!

- Print and online - the best of both worlds

- Effective recruitment and classified advertising

Quality editorial environment

- Unrivalled news service for product launches

- The most comprehensive coverage of industry events

- Regular surveys plus trading and economic reports

- Scheduled, topical features - download our features list

- Factsheet and technical pages ensure month-long usage

Everyone who's anyone is in The Stocklists

All the major trade organisations, industry bodies, buying groups are in the magazine every month.

More than 40 advertisers including all the leading brands advertise with us regularly and many have been advertising regularly with us for 20 or 30 years! Not because they can't break the habit! – they do it because it works!!

Advertising rates (and sizes)

All rates shown exclude VAT.

Publication and copy dates

Features list for 2021

Click here

to download our list of monthly editorial features

Advertising copy deadlines

(prior to online date shown):

Display advertising - 2 weeks prior. "POP" pages - 1 week prior. Classified - 1 week prior.Technical information

Digital artwork

PDF artwork must be distilled as 'PRESS READY' to PDF/X-1a standard and embedded images must be checked for CMYK. Please ensure all artwork has crop/trim marks.

If PDFs are not available, please supply InDesign 'packages' or Quark Xpress 'collect' files with all images and fonts or EPS files with outlined or supplied fonts or TIFF or uncompressed, print resolution JPEG. Resolution must be 300dpi at 100% actual size.

Not acceptable

Document files from any software other than InDesign, Quark, Illustrator or Photoshop. PDFs with RGB images. Files from Corel Draw and Microsoft Publisher are not acceptable. Please export as a 'press-ready' PDF - see above.

USB flash drives are acceptable but CD-ROM and DVDs are no longer OK. Note: digital artwork is required. Film is not acceptable.

Proofs

A matchprint, chromalin or iris hard-copy proof is required for colour accuracy. In all other cases a PDF or inkjet proof is required for reference (but with no guarantee of accuracy). Proofs are not normally supplied by The Stocklists unless requested.

Colour positions

Colour positions are available on art paper on the cover (4 positions) and in the bound-in 'Carpet & Floorcovering Review' section in the centre of the magazine. Bleed on colour pages is charged at 10% extra.

"Stocklister" or "POP" pages

"Stocklister" or "POP" (Point-of-Presence) pages are for manufacturers and main wholesalers using our service every month and are therefore discounted. They are allocated at the publisher's discretion and typically listed in alphabetical order.

Deadlines(prior to publication date):Display advertising - 2 weeks prior. "POP" pages - 1 week prior. Classified - 1 week prior.

Trim size: A4

Live matter margin: Live matter/text should not be placed closer than 12mm to any page edge

Screen size:

133/150 lpi

Digital artwork

PDF artwork must be distilled as 'PRESS READY' to PDF/X-1a standard and embedded images must be checked for CMYK. Please ensure all artwork has crop/trim marks.

If PDFs are not available, please supply InDesign 'packages' or Quark Xpress 'collect' files with all images and fonts or EPS files with outlined or supplied fonts or TIFF or uncompressed, print resolution JPEG. Resolution must be 300dpi at 100% actual size.

Not acceptable

Document files from any software other than InDesign, Quark, Illustrator or Photoshop. PDFs with RGB images. Files from Corel Draw and Microsoft Publisher are not acceptable. Please export as a 'press-ready' PDF - see above.

Supplying files

Send PDF files to diane@mayvillepublishing.co.uk (max file size 10MB) or davidspragg@thestocklists.com (up to 20mb).

We have a file transfer system available if emailing more than 20mb. Please ask for a link.

We have a file transfer system available if emailing more than 20mb. Please ask for a link.

USB flash drives are acceptable but CD-ROM and DVDs are no longer OK. Note: digital artwork is required. Film is not acceptable.

Proofs

A matchprint, chromalin or iris hard-copy proof is required for colour accuracy. In all other cases a PDF or inkjet proof is required for reference (but with no guarantee of accuracy). Proofs are not normally supplied by The Stocklists unless requested.

Colour positions

Colour positions are available on art paper on the cover (4 positions) and in the bound-in 'Carpet & Floorcovering Review' section in the centre of the magazine. Bleed on colour pages is charged at 10% extra.

"Stocklister" or "POP" pages

"Stocklister" or "POP" (Point-of-Presence) pages are for manufacturers and main wholesalers using our service every month and are therefore discounted. They are allocated at the publisher's discretion and typically listed in alphabetical order.

Classified adverts

Minimum space order is 2 single column centimetres.Copy deadlines

Click here for this year's publication dates.Deadlines(prior to publication date):Display advertising - 2 weeks prior. "POP" pages - 1 week prior. Classified - 1 week prior.