The tide turns for the trade

Retailers are ready for the rollercoaster of market conditions to turn against the trade later this year as the downside of the cost-of-living crisis reverses gains during the pandemic.

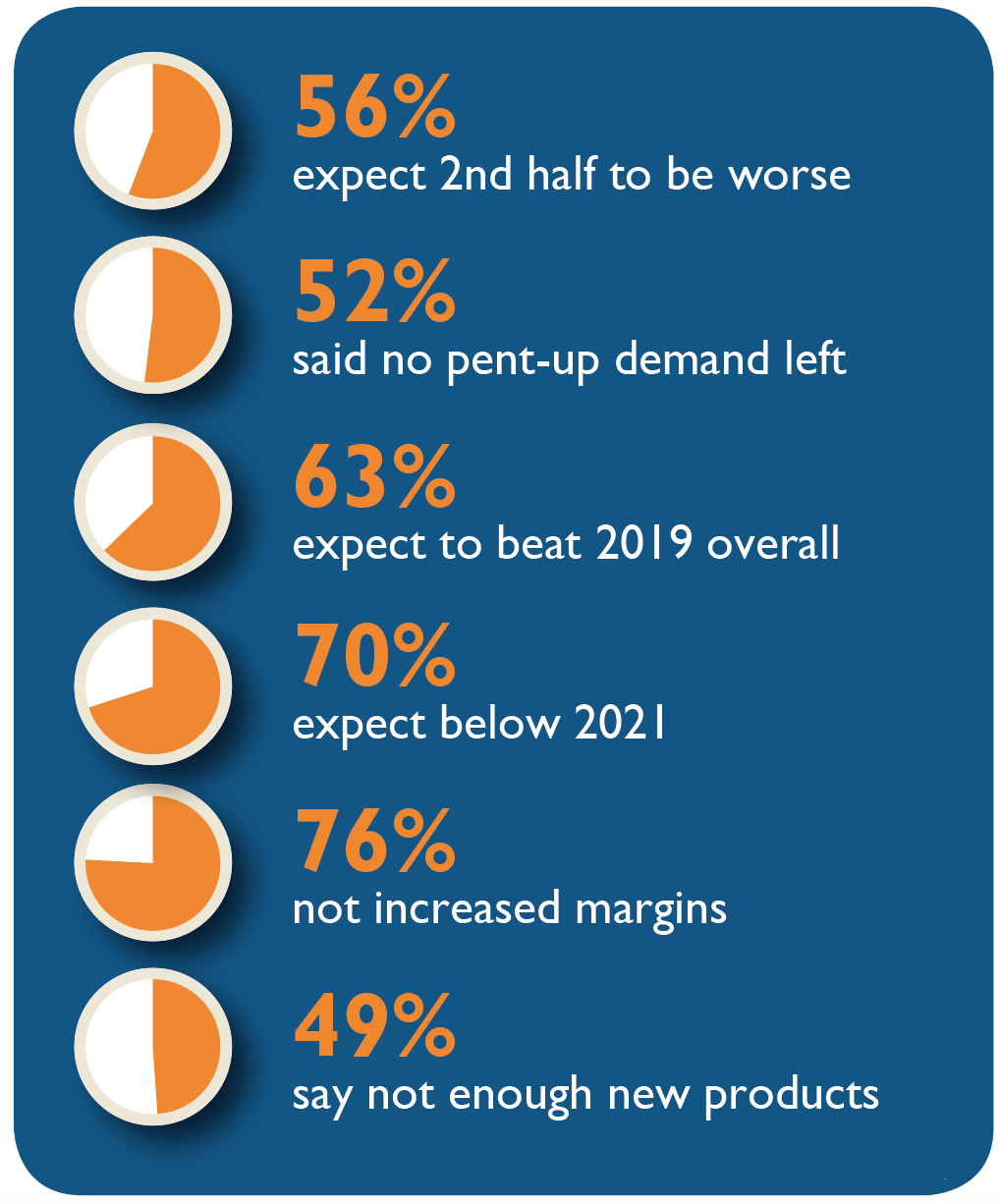

In our survey of readers taken in mid July, 70% expect to end this year with sales below those of 2021 and 63% says the sales performance will be below the “normal” year of 2019.

Of those, 19% expects sales to be down more than 10% and a further 14% expect sales to slide by more than 20%.

Only 27% are predicting a better year than 2021 and our statistics showed that retailers enjoyed a strong start to this but are pessimistic about the second half. 52% said the era of pent-up demand was over, while 39% see some backlog still coming through to support their sales.

“The business we have enjoyed over the last 18 months

was money people would have used for holidays,”

said a North East reader. “It’s common sense that we will

see a downturn now as that sector gets back to normal.”

Higher value carpet was singled out as the most resilient sector in the current market with budget vinyl doing the least well.

On pricing, it is no surprise that 95% of respondents say they have upped prices this year with half of all retailers applying price increases of more than 10% while 12% of our readers have put their prices up by more than 20%. Nevertheless, margins have been squeezed with only 19% saying they had been able to increase profitability so far this year.

We asked how retailers felt about the price increases from manufacturers and suppliers and the majority felt they had been reasonable and 55% said they had received, good timely information of increases. However, 40% suggested some profiteering had gone on during the period within those price increases.

Retailers were asked to rank their greatest challenges in

2022 and rising supplier prices topped the poll at 43%,

followed by finding fitters at 23%, finding customers

at 20% and getting deliveries on time at 13%.

“Supplier prices are having a real impact on business,” said a reader in Somerset. “At the moment, we only hold an estimate for 7 days. And I have noticed some suppliers even refuse to honour the price at the time of order.”

One retailer in Scotland also criticised the frustration of wading through suppliers’ brochures to find price increases when a simple spredsheet would speed up the tedious task of re-pricing.

Nearly half our respondents said the industry had generally risen to the challenge of overcoming the supply chain difficulties that plagued the trade in recent times though one respondent said deliveries from the EU had been “diabolical” at times.

But there was some dissatisfaction with suppliers on product development with a surprisingly high 49% of retailers saying that not enough new products were coming through to attract consumers’ attention.

A final comment from a retailer was an interesting sign of the times: “There has been a lot of changes in terms of reps and not all having been keeping in touch. This is disappointing really.

Still, if they are not bothered, nor am I.”